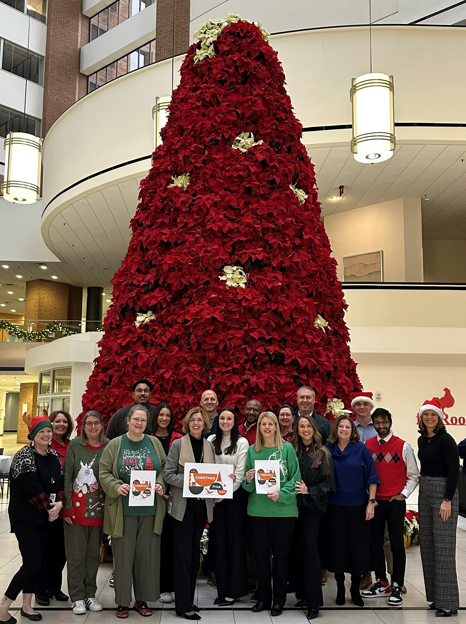

Created in collaboration with our friends at PNC Bank.

Most people know that the Consumer Price Index (CPI) is how the Bureau of Labor Statistics tracks the prices of regular goods and services. In 1984, PNC came up with a fun way to help consumers think about inflation and shopping by creating the Christmas Price Index to track CPI through the cost of the gifts from the song, “The 12 days of Christmas,” and compare it to the real-time outlook of shopping, saving and splurging this holiday season.

Most people know that the Consumer Price Index (CPI) is how the Bureau of Labor Statistics tracks the prices of regular goods and services. In 1984, PNC came up with a fun way to help consumers think about inflation and shopping by creating the Christmas Price Index to track CPI through the cost of the gifts from the song, “The 12 days of Christmas,” and compare it to the real-time outlook of shopping, saving and splurging this holiday season.

“This year, the total cost to buy one of each item from the song added up to $49,000,” said Nadine Givens, Senior Vice President and Indiana Market Director of PNC Private Bank. “That is an increase of 5.4% over last year, which is greater than the actual CPI.”

However, not all categories increased at the same rate. For example, the cost of the Partridge in a Pear Tree increased by 16%, mostly due to the housing-related cost of the tree, and the Six Geese-A-Laying was also up by 15.4%. On the other hand, this year’s best deal may be the Five Golden Rings, which did not increase at all, and the Four Calling Birds, which have remained steady for 10 years in a row.

What to keep an eye on for 2025 finances?

When Givens isn’t thinking about the price impact of holiday shopping, she and her team of local advisors are helping high- and ultra-high-net worth clients manage their finances strategically. And while she has many pieces of advice, there’s one tip she wants all Mavens to know:

“Taxes matter, as do tax implications this year, because they can have a meaningful impact on your future financial portfolio,” Givens said.

When you’re investing, it’s normal to experience gains and losses. One way in which Givens and her team help clients navigate some of those market swings is by utilizing tax loss harvesting, which means selling a security at a loss to offset current realized gains or future gains. Investors should also pay attention to which investments they hold in their retirement accounts versus taxable accounts. This can help investors pay less in taxes while still maintaining an overall balanced portfolio. But before making any moves that could potentially trigger a tax event, Givens advises consulting with both a financial and tax professional.

Speaking of retirement, Givens also wants investors to think about planning ahead, especially when it comes to their tax liability in retirement when they begin to draw income from their IRAs. “Tax rates could be higher in the future,” she said. “And if you have a traditional IRA, you may want to speak with your financial and tax advisors about whether you are eligible to open or convert to a Roth IRA, along with the potential implications of doing so. A Roth IRA is funded with post-tax dollars but allows for tax-free growth and distributions.”

The optimal time to do a conversion depends on an investor’s particular situation and income level, therefore it is critical to consult with a qualified financial planner or advisor and tax professional.

And a Health Savings Account (HSA) can provide for additional tax savings. Contributions to these accounts are deducted pretax, the portfolio grows tax exempt, and the funds are not taxed at distribution as long as they are used for healthcare expenses.

How do you give with your finances in mind

It’s the season of giving, and Givens says there is more than one way for clients and investors to give. Instead of donating money straight from your bank account, some clients may prefer to gift appreciated stock, which can have tax benefits.

Of course, you should talk to your financial advisor about how to donate your appreciated stock and make sure that the charity of your choice is set up to receive these types of gifts (most should be able to).

Another way to support organizations and boost your finances at the same time is to set up a donor-advised fund (DAF). A DAF is like opening an investment account directed towards charitable contributions. Many people contribute a large lump sum in one calendar year into a DAF and itemize their taxes to receive the charitable contribution deduction.

What makes a DAF different than a regular charitable contribution is that you’re not required to distribute the money immediately. You can make donations from that one contribution over a number of years. The dollars in the DAF will be invested and grow with the market.

“For example, let’s say you open a DAF with $10,000 and invest those funds. If the market is favorable and the value of the account appreciates, you could ultimately gift significantly more than the $10,000 you started with,” Givens said. “It might seem complicated, but it’s very easy and beneficial if you’re philanthropic-minded,” Givens said.

Bottom Line

Managing your finances can be stressful, especially during this time of year. If you’re having trouble getting organized, consider asking for help from a professional. They can offer budgeting, saving, or investing tips that you can implement.

Zina Kumok is a freelance writer, editor, and speaker specializing in personal finance. A former reporter, she has covered murder trials, the Final Four, and everything in between. She has been featured in U.S. News & World Report, Forbes Advisor, and Bankrate. She also paid off $28,000 worth of student loans in three years. She offers one-on-one money coaching at Conscious Coins.

SUPPORT LOCAL JOURNALISM

All of our content—including this article—is entirely free. However, we’d love it if you would please consider supporting our journalism with an Indy Maven Membership.

P.S. Sign up for our weekly newsletter with stories like this delivered to your inbox every Thursday!