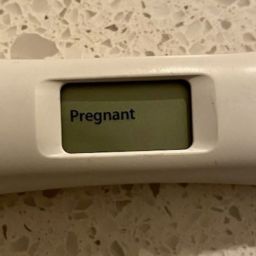

Welcome to our second personal finance column at Indy Maven. We’ll be tackling many of the money issues facing women today—from retirement savings to mortgages. But we’d also love to get hear what your questions are and what topics you’d like to see covered. Email us at editorial@indymaven.com! This week, Zina Kumok tackles the financial questions that come after finding out you’re expecting.

When you find out you’re going to have a baby, many things may cross your mind. Knowing that you’re about to bring another life into the world has a way of opening your perspective to what’s really important. Beyond that, the responsibility of becoming a parent can be frightening enough, but the price tag can be too.

Whether you plan for it or not, those hospital bills will find a way to your inbox. According to a study from the University of Michigan, the average cost to have a baby is $4,500—and that’s with insurance.

Thankfully, planning for the cost of childbirth doesn’t have to be stressful. If you put in a little forethought now, you’ll avoid having to make these same calculations in the sleep-deprived weeks and months after giving birth.

Here are some things you can do.

Examine Your Insurance Plan

If you’re pregnant now and due before the end of the year, you’ll probably have to give birth using the insurance plan you currently have. You can’t switch plans mid-year unless you have a qualifying event, like a new job, marriage, divorce, or housing relocation. You can usually switch plans after you’ve given birth, but not before.

If you can’t change plans, look at your current insurance plan to understand what you’ll owe. For most women, giving birth means hitting their total out-of-pocket max. Your benefits page should show what that figure is.

Depending on the plan, your out-of-pocket max may be as high as $8,200 or as low as $2,500.

Once you have that figure, look at your savings to see how much is available to pay for the remaining costs.

Save in an HSA

Anyone on a high-deductible health insurance plan will end up paying a lot out of pocket, but there’s a silver lining: Consumers on high-deductible plans are eligible for Health Savings Accounts (HSAs).

Contributions to HSAs are tax-deductible, and the current 2020 limit is $3,550 for individuals and $7,100 for families. You can hit the family limit if you and your partner are both on a high-deductible plan, and the individual limit if you’re the only one on an eligible plan.

If you’re on a high-deductible plan now, open an HSA and start saving for the birth. Once the medical bills start rolling in, use funds from the HSA to pay for them.

Stretch Out Payments

Giving birth isn’t the only part of a pregnancy that costs money. You also need to consider prenatal visits, lab work, and ultrasounds. Always make sure to see an in-network specialist or lab company, as you’ll pay more with an out-of-network provider.

Ask the doctor’s office if there are any discounts available, especially if you earn below a certain amount. Once you receive the final birth-related bill, call the hospital and ask to go on a payment plan.

Non-profit hospitals sometimes allow you to pay as little as $5 a month if you can’t afford the total bill. For-profit hospitals are usually less forgiving but still tend to have 12-month payment plans.

Stretching out the payments will allow for more flexibility in your budget, which is crucial if you’re taking unpaid time off from work.

Zina Kumok is a freelance writer in Indianapolis who paid off $28,000 worth of student loans in three years. As a journalist, she’s covered everything from murder trials to the Final Four. Find her financial coaching business at ConsciousCoins.com.