Did you set lofty budgeting goals for 2025? By now, many people have abandoned their financial resolutions and thrown caution to the wind at the slightest inconvenience or hiccup in the road. Don’t worry—you’re not alone, and all is not lost. I’m here to help you pause, take a breath, and get back on track. Let’s firm up those goals, reset your mindset, and keep moving forward. Don’t let an endless-feeling January derail your budgeting success for the rest of the year!

Here are five simple but powerful steps to get back in the driver’s seat of your finances:

1. Review Your Goals and Adjust if Needed

Life changes—your budget should too. Take a moment to revisit the goals you set at the start of the year. Ask yourself:

- Are these goals still realistic, given my current circumstances?

- Do they align with what I value most right now?

For example, if you planned to save aggressively but encountered unexpected expenses, consider adjusting your timeline or focusing on smaller wins. Flexibility doesn’t mean failure–it’s part of realistic goal-setting.

2. Find a Spot to Track Your Budget

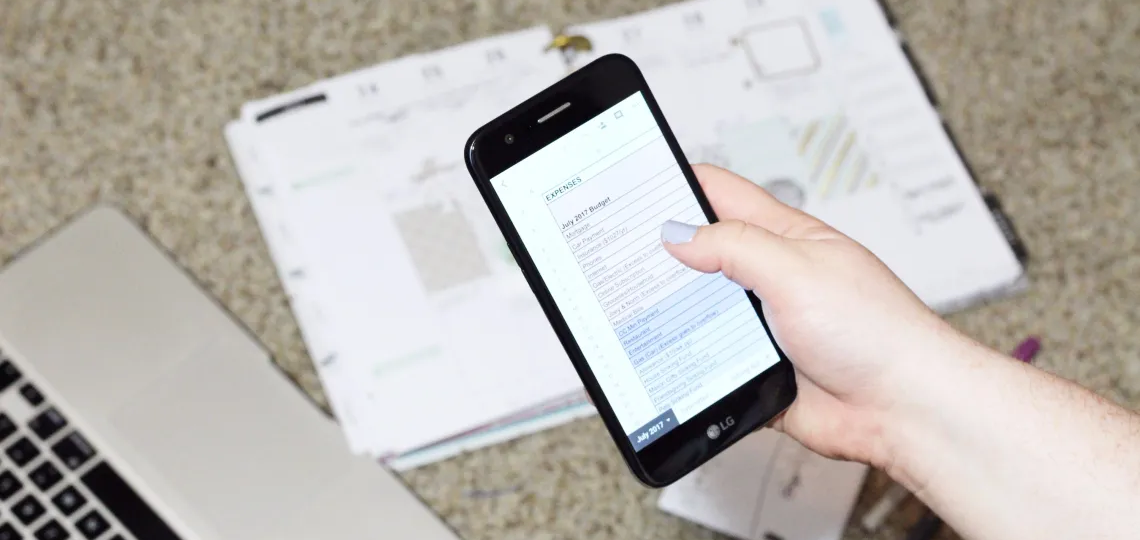

Consistency is key when managing your money, so choose a system that works for you. Whether it’s a dedicated budgeting app (like YNAB, Mint, or EveryDollar), a spreadsheet, or an old-school notebook, the important thing is to have one centralized place to track your income, expenses, and progress.

Tracking allows you to see where your money is going and identify patterns—both good and bad. Once you see the numbers, you can make informed decisions to redirect your spending or saving efforts.

Want to try what Brittney does? Try her monthly or yearly budget spreadsheets!

3. Get an Accountability Partner

Having someone to share your financial journey with can make a huge difference. Whether it’s a partner, friend, family member, or even a financial coach, an accountability partner can:

- Offer encouragement when you’re tempted to veer off course.

- Celebrate your wins, big or small.

- Provide perspective and advice for tricky financial decisions.

For added accountability, consider sharing your short-term goals with your partner and scheduling regular check-ins to discuss your progress.

4. Check in With Yourself Often

Don’t set it and forget it—budgeting is an ongoing process. Build time into your weekly or monthly routine to evaluate how you’re doing. A simple check-in could include:

- Comparing your actual spending against your budget.

- Assessing whether you’re meeting your savings goals.

- Identifying areas where you could cut back or reallocate funds.

Think of these check-ins as mini resets. The more often you review, the less likely you are to drift too far off track.

5. Make Small Improvements Every Day

Progress doesn’t have to come in giant leaps; small, consistent steps add up over time. Look for little ways to save or spend smarter every day, such as:

- Packing your lunch instead of eating out.

- Canceling subscriptions you’re not using.

- Shopping your pantry before heading to the grocery store.

The goal is to build momentum with small wins. Over time, these habits will become second nature, and you’ll see the cumulative impact on your financial health.

The Bottom Line

Getting off track with your budget isn’t a reason to give up—it’s an opportunity to recalibrate and refocus. Budgeting is a journey, and it’s okay to make adjustments along the way. By taking small, intentional steps like the ones outlined here, you’ll find yourself building a stronger, more sustainable financial foundation for the rest of 2025.

Now’s the perfect time to reflect, reset, and recommit to your goals. You’ve got this!

SUPPORT LOCAL JOURNALISM

All of our content—including this article—is entirely free. However, we’d love it if you would please consider supporting our journalism with an Indy Maven Membership.

P.S. Sign up for our weekly newsletter with stories like this delivered to your inbox every Thursday!